Content

Goldman Sachs has just reiterated their price address to have gold, making little doubt for the bank’s current status. „To your labor industry no more deterioration and you will user demand nevertheless appearing good, attention in the usa features alternatively gone back to rising cost of living risks. A series of listing-breaking rallies for a lot of the year saw gold climb up in order to a most-day high of 2,790/ozt to the October 31, before cooling-off. A-year out of tall development mostly arrived due to rate of interest incisions because of the You.S. Bitcoin, the largest cryptocurrency by the market cover, was released last year.

Along with myself playing games, you might discuss occupation opportunities in the playing community, such video game journalism and you will advancement, otherwise customer service opportunities, that offer big salaries. Bucks award online game are not available in particular places, along with DE, La, MD, MT, TN, Inside, Me, and Colorado in the us, and you will Act, VIC, QLD, and NT around australia, due to local laws. Solitaire Conflict revitalizes the traditional solitaire configurations, difficult players so you can swiftly organize and you may sequence notes to exceed rivals.

Silver cost fell come early july when rising crude oils costs brought about rising prices, Treasury efficiency, and also the You.S. dollar to go up. The fresh offer-away from try high sufficient to cause the SPDR Gold Offers replace-traded finance — the greatest ETF backed by bodily silver — to fall 12percent from its Will get large so you can their October reduced. The new affordable high has arrived despite outflows away from silver-supported change replaced fund away from 21mn ounces previously year, considering Bloomberg. However, bitcoin, and therefore strike a new higher a lot more than 72,000 to the Tuesday, could have been increased by huge amounts of bucks pouring on the ETFs while the they released in the us a couple months back. SlotoZilla are a different website having 100 percent free casino games and reviews. Everything on the site has a work just to entertain and educate group.

Secret highlights:

BullionVault’s silver rate graph shows you the current cost of silver in the professional gold bullion field. When you’re silver is renowned for maintaining the well worth across the long identity, several issues affect the small-identity prices. Have and you may consult, and trader conclusion, could affect the price of the brand new steel. For the likewise have side, changes in development account by the exploration enterprises can impact just how much gold is available in the business. Of several people check out common financing and ETFs for example SPDR Gold Shares (GLD).

Additional Silver price charts

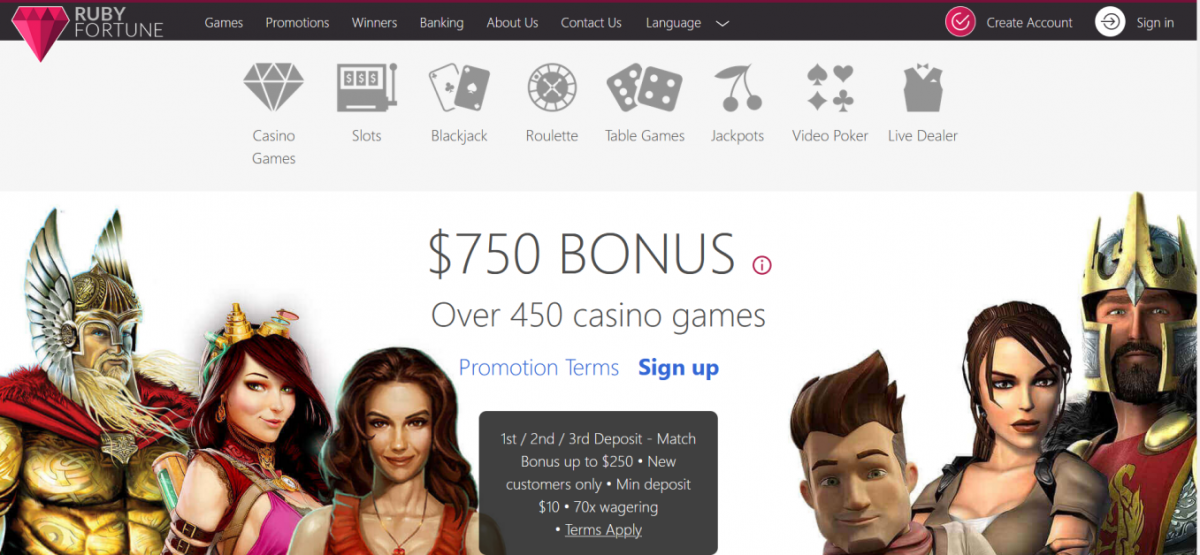

If you’d like a chance to hold the “gold” the thing is in this slot online game, you’ll must check in your account to make in initial deposit. Performing an account is not difficult, so there are lots of payment tricks for professionals. Since the put is done, you might allege an exclusive Acceptance Package that you can use playing real money position game. Citibank have around three-, six- and you will several-month predicts that should build gold investors be ok with carrying their gold and silver. Citi Look increased their three-few days anticipate from dos,700 in order to 2,800.

To the You fiscal shortage widening and you will G7 economic climates entering a age design revitalisation and you may deglobalisation, silver is increasingly reported to be a hedge facing economic instability. At the same time, extreme resource valuations inside the collateral locations restore memory of your own monetary excesses of the 1920s and you may 90s. Otavio Costa, macro strategist from the Crescat Investment, asserted that „the nation are sense a bona-fide-date records example to your importance of silver“. Still, particular people might wish to spend some a tiny part of its portfolio to gold — it is strongly recommended keeping they below 5percent — as the insurance against a financial tragedy, Bernstein said.

You.S. Lender Worldwide Financing Characteristics

The newest Provided’s Report on Monetary Projections inside the December implies we can find about three rate decreases inside 2024. There is visit this website here certainly, but not, a great part of gold’s recent efficiency that may’t become told me by the GRAM and this – just like any almost every other model – hinges on the strength of historic relationships. As such, there are some additional factors which can give an explanation for more raise. Gold’s evident boost provides while the caught the interest out of industry people.

Dollar-cost averaging and serves as an invaluable approach but if silver continues on their good rally to begin 2025. Thomas predicts one gold often arrive at step three,000 for each and every troy oz by the end out of 2025. One to price address is short for a great 17percent update out of newest account.

The brand new exchange war even offers created substantial suspicion to possess businesses and you may traders. It is also fueling global stress amongst the You and its largest trade couples — and you will stoking concerns in regards to the increasing likelihood of a You.S. credit crunch. Silver is additionally rallying, specific experts say, because the rates are nevertheless near low in the major create economic climates, plus they might not go up to traders got requested. Regulators bond rates are in fact therefore reduced in European countries and you may Japan which they’re in fact bad; people try using governments to the right of credit them money. Additionally, specific bonds spend shorter desire than simply prevailing inflation prices, which means investors are practically protected a loss of profits, just after rising prices, whenever they contain the bonds in order to maturity. Gold bullion doesn’t spend something, obviously, and you can runs into storage or any other will set you back.

An educated advantage allocation may vary considering your financial desires, exposure tolerance, and you may day views. For this reason, people must look into silver a prospective part of a great diversified profile, maybe not a stay-by yourself financing. And you may, just like any funding, it is prudent to see a monetary coach to choose if and just how gold suits into your wider monetary bundle. Gold provides a keen inverse correlation on the United states Dollar and you can You Treasuries, which are both biggest put aside and secure-refuge assets. If Dollars depreciates, Silver can go up, helping traders and central banks so you can broaden the assets in the turbulent minutes. An excellent rally in the stock market has a tendency to weaken Gold speed, when you are sell-offs within the riskier segments often like the fresh rare metal.

Silver, usually considered a refuge, has mounted roughly 30percent in 2010, outperforming the new benchmark S&P five hundred index’s 20percent get. Who has in part started determined because of the a bounce sought after of central financial institutions along with inside China, Chicken and you may Asia, who’ve put in its gold piles this year in order to broaden away from the Us dollars. Just days later, on the Friday recently, the fresh precious metal’s rate soared to help you a record most of 2,450 per troy oz — delivering the growth to help you twenty-five percent since the Oct 5, just before disagreement erupted in between Eastern.

Demand for silver because of the traders is even critical, and because the fresh metal can be used as the an excellent hedge against rising prices and you may intertwined on the worth of the newest dollar, these types of considerations as well as apply to silver consult. Gold rates features has just surged so you can the newest all of the-date highs, and the outlook remains optimistic. If or not your’re an experienced individual otherwise fresh to the new gold and silver market, knowing the issues operating such growth is vital. This information delves for the as to the reasons the brand new silver rally is expected to remain, inspired by geopolitical stress and you will positive technical indications. A major catalyst for a potential Chinese silver mania is the state’s serious economic turmoil. Using its a home and you can inventory segments plunging, a projected 18 trillion inside the household money could have been damaged—an economic crisis similar to China’s form of the fresh 2008 High Recession.

Stocks eventually retrieved and forced up on the the newest levels from the 2010s. Inside 2020s, each other stocks and you can gold have experienced the newest all of the-go out highs.Out of 2003 due to 2023, silver returned on the 8.9percent per year, a little outperforming the new S&P 500’s 8.4percent annual go back (leaving out dividends). Yet not, the new S&P five-hundred averaged over tenpercent per year, along with dividends. Gold’s efficiency were smaller impressive more than longer panorama.